Table of Contents

In love and regard for this powerful pattern (one of my best technical buddies), I also call it the “Shampoo Pattern” 🧴

But here’s the real catch:

👉 You have to spot this pattern when the right shoulder is in the making to harness the maximum risk-reward (RR).

🔍 Trade 1: Tilted H&S (19th Aug, Tuesday, 10:20 AM)

- First noted in 15-min time frame, but wasn’t clear. Had to zoom into 5-min tf.

- At this point (10:20 am), PE writers were gaining strength at 24,900, even though CE writers had been dominating since morning.

- Pattern recognition here gave the first hint of possible reversal.

- Nifty moved from 24,920 to 25,000 in next 2 hrs.

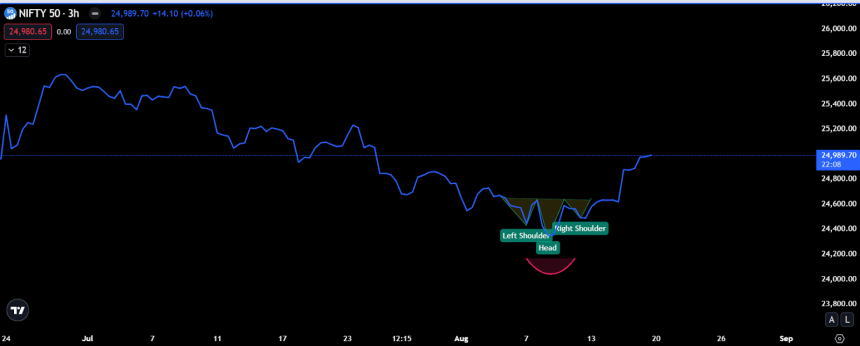

🌍 Trade 2: Global Context & 3-Hr Time Frame (12th Aug, Friday, 12:15 PM)

Scenario Setup

- Post Trump’s tariff announcement (8 Apr 2025), markets worldwide—including ours—rallied from 21,700 to 25,500 (+4,000 pts rise, ~18% in <3 months).

- The correction: in the next 40 days, we fell to 24,337 (–1,350 pts, ~5.2%).

- Fibonacci retracement: 38%.

- Bigger picture here is in 3-hr time frame.

The Dilemma

- Left shoulder too close to head 🤔—intuition says inverted H&S, eyes don’t confirm.

- Possible bottom of a 40-day bearish phase.

- Could be a huge RR opportunity if confirmed.

Line Chart to the Rescue

- Switching to line chart solved it ✅

- Left shoulder synced perfectly.

- Next 2 days: Nifty opened Gap Up and sustained the day’s bottom.

- Covered nearly 50% of the fall in just 3 trading sessions!

Trading Takeaway

- Best play here = Far expiry OTM option – BUY.

- Buying far OTM options with small SL could give 1:3 RR.

📅 Trade 3: Daily Time Frame

- As I said earlier—the best H&S trader is the one who spots the right shoulder before it’s fully formed.

- If left shoulder + head is already visible → expect a bounce from neckline → anticipate right shoulder.

- Example: On 6th July 2025, I realized that if Nifty had to fall below 24,500 (towards 24,000), an H&S had to play out.

- Bounce confirmed near 25,000 (where left shoulder was).

- Result: Nifty rose 677 pts, making a high of 25,153.

📌 Current Scenario (25th Aug 2025)

- Nifty is again near neckline 24,500, right shoulder complete.

- Once again, we see left shoulder + head already in place.

- As loyal students of this Shampoo Pattern, we expect a bounce → right shoulder → move down.

And guess what?

👉 Market opened with a Gap Up today 😄 at our right shoulder

👉 If our neck line does not break in a day or two, our H&S studies fails & we, most probably become sideways.

💡 Key Learnings

RR setups in H&S can be massive if entered at the right stage.

Multiple time frames reveal unique versions of the same pattern.

Intuition + confirmation tools (like line chart) are crucial.

The real edge is spotting the right shoulder before it’s complete.