In Part 1, we covered the theory of Head & Shoulder (H&S) patterns and how they look across different time frames. In this Part 2, we move to past market examples where the H&S pattern has already played out.

The idea is simple: learning from history. By reviewing past H&S cases, you will:

* Build confidence in spotting valid vs invalid setups.

* Understand how price behaves around the neckline and shoulders.

* Train yourself to wait for confirmation and avoid premature entries.

—

Example Studies

1. Gujarat Gas

* Retesting is usually the best entry in H&S.

* But do we practice it religiously?

* Earlier, my confidence was low until I learnt proper level marking (thanks to i4option mentor).

* Now, I wait patiently for my levels like an eagle.

2. Hero MotoCo

* Found sideways channel formation after right shoulder.

* Question: was my H&S valid?

* Key observations:

* If right shoulder high point is broken → H&S invalid.

* If not broken → original direction estimate holds.

3. Hindustan Unilever

* When confused, switch to Line Chart.

* If left shoulder took long to form, expect similar time for right shoulder.

* Gap-up opening = strong indication of successful breakout.

4. Angel One

* I would like to name this entity as Godfather of H&S.

* Example of how macro news affects pattern: stock fell after SEBI chairman hinted at changes in expiry rules.

* Reminder: Fundamentals can sometimes override technicals.

5. Navin Fluorine

* H&S formed at the top of a bull run – already a red flag.

* Once right shoulder broke, trend direction was clear.

* But I avoid such opposite trades unless Risk:Reward ≥ 1:3.

6. Alkem Laboratories

* Did not follow the H\&S trajectory.

* Stock bounced back from neckline → showing bullish behaviour instead.

* Lesson: H\&S doesn’t always play out.

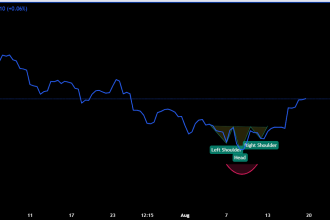

7. Dr. Lal Path Labs

* Expected right shoulder in a circular region → but price broke straight below neckline.

* Confusion resolved via Line Chart:

* H&S had already formed.

* After sideways action, neckline broke and bull run started.

—

## Key Takeaways

* Past examples are your best teacher. Review them to sharpen instinct.

* Always check line charts when candlesticks confuse you.

* Right shoulder behaviour decides validity.

* Neckline reactions (bounce or break) reveal true market bias.

* Combine H\&S with risk:reward logic – never trade for less than 1:3.

—

📌 Homework for Readers: Revisit charts of these stocks on your system. Draw the neckline, mark the shoulders, and check whether you would have traded or avoided. Compare your judgment with the actual outcome – this is how you build conviction.