In today’s fast-paced markets, having access to live option chain data is essential for any serious trader. i4option delivers exactly that: an ultra-fast, analytics-rich platform empowering you to interpret, strategize, and execute with clarity. we’ll dive deep into how to master the live option chain on i4option — from the layout and key metrics to strategic use in real-world trading. Plus, we’ll walk you through example setups and highlight best practices to stay ahead.

Why Live Option Chain Analytics Matter

An option chain is a structured matrix displaying all available call and put contracts for an underlying asset—each strike and expiry laid out together arXiv+12Option Alpha+12Investopedia+12. With live analytics, dynamic updates on bid/ask, open interest, implied volatility (IV), and Greeks become powerful signals for market sentiment and opportunity.

i4option’s live data feeds are notably rapid and reliable. Whether you’re identifying support/resistance through open-interest concentration or tracking shifts in IV skew, you’re getting actionable intel in real time live.i4option.comYouTube.

Navigating the Interface

A. Layout & Strike Ladder

The middle shows strike prices in the center with call and put columns on either side. An ATM marker highlights the strike closest to the current index level. This structure enables easy comparison of out-of-the-money (OTM), at-the-money (ATM), and in-the-money (ITM) contracts.

B. Live Quotes & Volume Data

For every option contract, you see real-time:

-

Bid / Ask / Last Traded Price – Essential for gauging liquidity and spread

-

Volume – Today’s activity

-

Open Interest (OI) – Outstanding contracts data

Changes in OI across the chain can hint at fresh flows or unwinds — especially where institutions are placing large moves.

C. Greeks & IV Skew

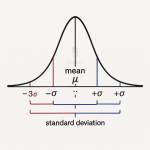

i4option surfaces Greeks (Delta, Gamma, etc.) and IV for each strike. Look for IV divergences — higher IV in OTM strikes signals increased demand — often from hedging activities

Key Analytical Techniques

🔺 A. Support & Resistance via OI

Plot the call strikes with the highest OI — they tend to act as resistance. Similarly, puts with high OI often mark support zones HDFC Sky. Monitor day-to-day OI growth; if a call strike’s OI jumps, institutions may be shorting there, defining a barrier.

📈 B. IV Skew Detection

Watch the IV curve across strikes. A rising skew (higher IV on OTM puts) may indicate fear or tail-hedging. A plateau or inverted skew suggests complacency or covering dampening on one side.

⚖️ C. Volume-to-OI Discrepancy

High volume with low OI can signal new interest. Conversely, high OI with low volume may mean hedges sitting idle. i4option flags these scenarios for quick review.

📉 D. Greeks-Based Positioning

Focus on high Gamma strikes near the money — they offer rapid reactivity to price movements. Delta-heavy strikes (ITM calls or puts) reflect directional plays requiring careful risk management.

Creating Trade Setups

Example A: Bear Call Spread on IV Spike

-

Spot a sharp IV increase in OTM calls (e.g., +20%) — indicative of an overbought premium.

-

Sell the IV-rich call and buy a higher strike call to define risk.

-

Monitor IV mean reversion — profit comes as IV drops, especially pre-earnings.

Example B: Support Anchor with Put Buying

-

Identify a put strike with heavy OI—likely forming a support base.

-

If the underlying drifts toward it, buy that put as a hedge or directional bet.

-

Track delta and gamma to calibrate trade size and exit logic.

Execution, Alerts, and Integration

🔔 Smart Alerts

Set alerts on strikes when certain thresholds are met — like volume surges or IV changes. These signals can trigger strategy setups, so you’re not passively watching the screen Option Alpha.

💻 Broker Integration

i4option can connect directly to supported brokers — place orders right from the chain. It visually marks your orders in the chain, so you always know your market impact GoCharting+15Facebook+15YouTube+15.

📘 Data & Learning Hub

i4option offers webinars and documentation to help traders understand data points and refine workflows Interactive Brokers+2YouTube+2quantsapp.com+2. Leverage their academy for strategy replication and tool mastery.

i4option turns raw option chain data into a potent decision-making engine. By mastering live OI mapping, IV skew detection, Greek insights, and integrated alerts/orders, you’re not just analyzing—you’re acting with precision.