Corporate governance sounds like a big, technical phrase—but at its heart, it’s simply about how companies are run, especially how decisions are made, how honest they are with investors, and how they protect everyone’s interests. In India, good corporate governance has become especially important—not just as a set of rules, but because it really affects how companies perform in the Indian stock market. Investors using indexes like the Nifty 50 or advanced tools for option trading India and trading analytics tools can directly see the influence of governance practices on market confidence, volatility, and stock pricing.

This blog explains what corporate governance looks like in India, how it impacts stock prices and investor confidence, and why it matters to everyday investors—whether you’re trading with a day trading app India, the Best trading platform India, or relying on analytics from equity market analytics tools.

1. What Is Corporate Governance in India?

Corporate governance means the framework of rules, practices, and processes through which a company is directed and controlled. In India, this includes:

- Board structure, especially independent directors and inclusion of at least one woman director on every listed company’s board (details you can track via equity market analytics platforms and Charts).

- Transparency and disclosure requirements, like full financial reports, related party transaction disclosures, insider trading policies, CSR reports, and more—essential data for robust option chain analysis and research.

- Audit committees and risk management to safeguard assets and control misreporting.

- Shareholder rights and ethical conduct, including minority shareholder protections and whistle-blower norms.

Key legal pillars include Clause 49 of the listing agreement (now in LODR regulations) and the Companies Act 2013, with support from SEBI’s Listing Obligations and Disclosure Requirements (LODR) of 2015. The Companies Act has added tighter real-time disclosure rules in 2025, making timely information available for those monitoring live market data India and historical market data India.

2. How Governance Influences Stock Market Performance

A) Reduces Risk of Fraud and Stock Crashes

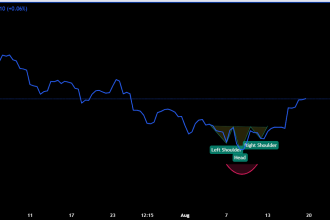

Poor governance often leads to shocks—remember the Satyam scandal of 2009. Those tracking the NSE option chain or Bank Nifty option chain have seen how poor governance can trigger price crashes and shake confidence, even for those applying strategies using index option trading and trading analytics tools. The IndusInd Bank accounting glitch in 2025 caused a 25% market value drop—reminding everyone, including users of tools like I4option, why governance matters.

B) Builds Investor Confidence & Pulls in Foreign Funds

Strong governance attracts trust from local traders and the wider financial trading community—and is especially crucial for international funds. Even high-profile cases like the Adani Group controversy (2024–25) haven’t derailed overall institutional confidence, thanks to competent governance frameworks tracked on the Nifty 50.

C) Improves Financial Metrics and Credit Ratings

Academic studies link strong board oversight and transparency (observable via Indian stock market tools and even in option chain analysis) with higher ROA and ROCE, boosting confidence in strategies tested with backtesting trading strategies.

D) Discourages Earnings Management

Robust governance supported by clear reporting standards (reinforced using back testing and historical market data India) reduces creative accounting and promotes honest reporting.

E) Encourages Long-Term Investing

Companies committed to ethical practices and compliance attract more patient, long-term investors—an insight valuable for those employing swing trading tools or creating advanced strategies with strategy builder modules.

3. Trends and Reforms in India

Regulatory Push:

SEBI continues to tighten requirements—introducing mandatory board performance reviews in July 2025. Analysts and retail investors keep up through option learning portals, Mock trade simulators, and day trading app India notifications.

Gender Diversity:

Despite a legal mandate, only 37% of Indian listed companies have senior women leaders. Many Best trading platform India solutions and equity market analytics dashboards highlight this metric for stock assessment.

ESG and Sustainability:

Governance now includes ESG and Business Responsibility Sustainability Reporting (BRSR). The latest option trading India platforms integrate real-time governance and sustainability indicators, often accessible through Charts and analytics.

Technology and Disclosure:

Digital platforms, live market data India, and I4option-style features help companies accelerate compliance and enhance transparency for investors and traders alike.

4. Real‑World Examples

Satyam Scandal:

The collapse from ₹544 to ₹11.50 underscored why governance matters. This remains a case study for users of NSE option chain and historical market data India tools when backtesting extreme scenarios.

IndusInd Bank:

Early 2025, governance failures led to a major accounting shock, which remains a cautionary tale for those deploying banking analytics, option chain analysis, and trading on Indian equities.

Adani Controversy:

Ongoing regulatory vigilance and resilient frameworks—regularly discussed in the financial trading community—helped preserve market confidence despite headline risk.

5. What This Means for Investors

Whether you are a retail participant, institutional investor, or overseas fund, a focus on corporate governance reduces risk and typically supports better returns—a principle built into many option chain analysis modules and backtesting trading strategies. Global investors choose companies that demonstrate compliance, diversity, and transparency-metrics now easily compared on the Best trading platform India and various Indian stock market tools.

Use Charts, option chain analysis, and backtesting trading strategies to validate company performance in relation to governance signals, especially across the Nifty 50, Bank Nifty option chain, and index option trading spaces.

6. Mixed Evidence—Why It’s Not Always Clear‑Cut

Not every analysis shows a direct performance boost from governance reforms-reminding savvy traders and investors, especially those enrolled in trading education India or exploring option learning, that best practices have to be meaningfully adopted for true equity market transformation.

Putting Governance into Practice: How to Make Smarter Investment Decisions

Good corporate governance is not just a regulatory checkbox—it is foundational to trust, long-term value, and robust performance in the Indian stock market. For anyone using option trading India, backtesting with Mock trade platforms, reviewing the NSE option chain, or deploying a custom strategy builder, integrating governance evaluation with analytics and market data—from the Best trading platform India to community-driven research—gives you a critical edge.

Scrutinize governance when analyzing any company, combine those insights with advanced analytics and real-time tools, and you’ll be better equipped for consistent, confident investing in India’s fast-moving financial markets.

If you’d like further tweaks or wish to see more keywords featured, just specify which ones and how prominently you want them placed!