Event Day Strategy in Action: Long Strangle on RBI Policy Day

Strategy: Deep OTM Long Strangle

Event: RBI Monetary Policy Announcement

Instrument: Index Options (Nifty or BankNifty)

Objective: Capture IV spike and directional movement using limited capital

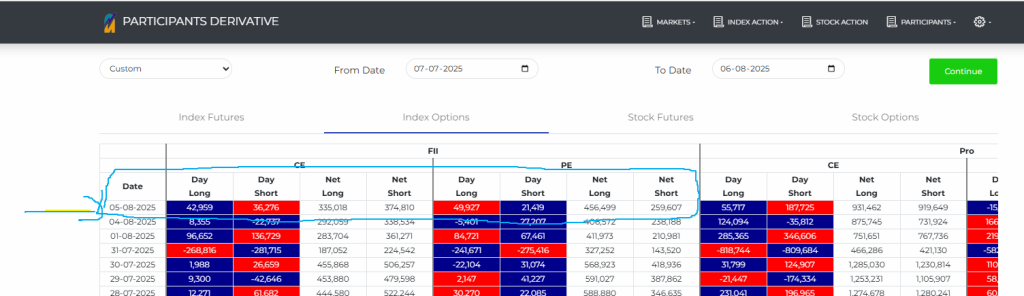

🔍 Market Setup: Clues from FII Data

The day before the RBI announcement (Tuesday EOD), open interest data revealed that Foreign Institutional Investors (FIIs) had built up large positions:

Such balanced and aggressive buying across calls and puts indicated expected volatility, which is perfect for a long strangle strategy—buying both CE and PE, but at different strikes.

🧪 The Actual Trade

- Entry Time: 9:16 AM (event scheduled at 10:00 AM)

- Strategy: Long Strangle with Deep Out-of-the-Money strikes

- 26150 CE contracts bought qty 100 lots, i.e, 7500 entry price .45

- 22800 PE contracts bought, qty 100 lots, i.e, 7500 entry price .45

- Capital Deployed: ₹6,750

🔼 Performance Snapshot

| Metric | Value |

|---|---|

| 📈 Max Profit | ₹1,500 |

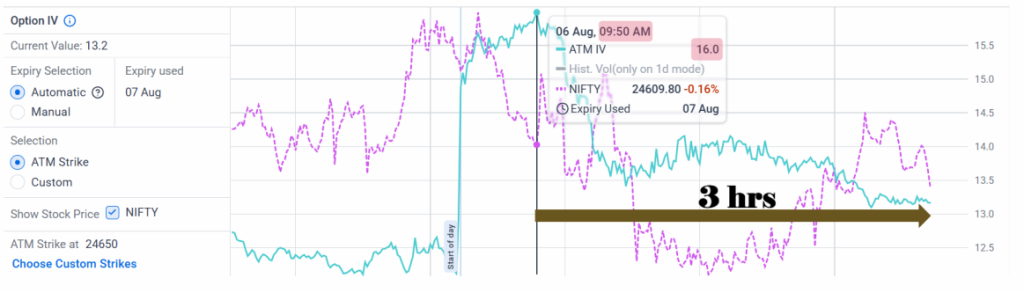

| 🕒 Time of Peak IV | 9:50 AM |

| 💰 ROI at Peak | + 22% |

This profit was achieved within 35 minutes, as Implied Volatility (IV) spiked due to market uncertainty around the RBI policy.

🔽 What Happened Next?

- By 12:50 PM:

- IV dropped from 16 to 13

- Position P&L was at -₹375

- Loss on deployed capital was just ~5%

Even after IV cooled off, the risk remained limited—showing the advantage of using deep OTM strikes in strangles.

💰 Bigger Picture Simulation (₹1 Lakh Capital)

| Scenario | Approx. P&L (₹) | ROI |

|---|---|---|

| Peak IV (9:50 AM) | +22,000 | +22% |

| IV Drop (12:50 PM) | -5,000 | -5% |

This real-world experiment shows how timing and volatility can turn simple setups into high-reward trades with limited downside.

💡 Key Learnings from This Strangle Setup

✅ Works best during macro events (RBI, Fed, Budget, Elections)

✅ Low capital required due to deep OTM strikes

✅ Maximum gains occur before or during IV spike

✅ Can exit early or trail based on momentum

❌ Not ideal for flat or low IV environments

🧠 Strategy Recap: Why We Call This a “Deep OTM Long Strangle”

- Straddle = Same Strike CE + PE

- Strangle = Different Strikes CE + PE

- This strategy utilized deep OTM CE and PE, resulting in lower premiums, a larger breakeven range, and higher IV sensitivity.

📢 Final Thoughts

If you’re looking for a smart way to trade event days, the Long Strangle with deep OTM options can deliver strong results—especially when IV spikes or price makes a breakout move.

A modest capital of ₹6,750 gave up to 22% return in under 1 hour with a max risk of ~5%. That’s the power of right setup + right timing.

🎓 Learn These Strategies with i4Academy

Want to master trades like this with live examples and Greek-based decision-making?

👉 Join our i4Academy program:

- Real setups explained

- IV & Vega impact in action

- Exit rules & adjustments

🔗 Explore courses on i4Academy